If you handle payroll with QuickBooks, a primary duty as an employer is submitting QuickBooks Form 941 — the Employer’s Quarterly Federal Tax Return. This IRS form reflects the federal income taxes deducted from employees’ wages, including both the employer’s and employee’s shares of Social Security and Medicare taxes.

For numerous business owners, completing and submitting Form 941 may appear challenging, particularly if you are uncertain about how to use QuickBooks’ payroll functionalities. However, the reality is that QuickBooks simplifies the process of preparing, reviewing, and electronically submitting this form, provided that your payroll information is correct and current.

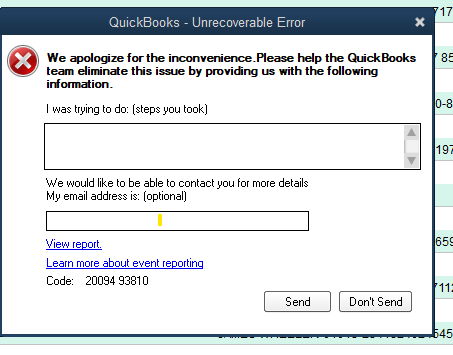

This comprehensive guide will outline how to prepare and submit QuickBooks Form 941 effortlessly, the information required, and the process for printing or e-filing it directly with the IRS. We will address some troubleshooting suggestions in case you face problems such as the QuickBooks Unrecoverable Error while completing the process.

How to Prepare and File QuickBooks Form 941 Easily

Make sure you have the most recent payroll tax table updates installed and that QuickBooks Desktop is up to date before filing. These changes guarantee that your tax computations and documentation adhere to the most recent IRS regulations.

To properly prepare and submit your QuickBooks Form 941, follow these steps:

Step 1: Compile the Necessary Data

- Prior to beginning, you will require access to:

- Your EIN, or Employer Identification Number

- The legal name and address of your business

- Total compensation received for the quarter

- Employees’ federal income tax withheld

- Social Security and Medicare contributions made by employers and employees

- Any modifications for group-term life insurance, tips, or sick pay

The majority of this data is automatically calculated by QuickBooks using your payroll records, but it’s a good idea to double-check everything for accuracy before submitting.

Step 2: Open Form 941 in QuickBooks

Here’s where to find the form in QuickBooks Desktop:

- Navigate to the Employees menu.

- Select Payroll Center.

- Select the File Forms tab.

- Choose the Employer’s Quarterly Federal Tax Return (941), from the list of forms.

- Click “Create Form.”

Most fields will be automatically filled in by QuickBooks using the information from your payroll. Make sure all the entries accurately reflect the reporting quarter’s totals by carefully going over each one.

Step 3: Confirm the Company Information and the Quarter

Select the appropriate quarter you’re filing for when the form opens (Q1: January–March, Q2: April–June, etc.). Verify again that your address, EIN, and company name are accurate; even a minor typo can result in processing problems for the IRS.

QuickBooks may issue an alert asking you to check and correct any errors before proceeding if it finds any discrepancies in your payroll data. Prior to filing, always take care of these warnings.

Step 4: Examine Tax Calculations and Payroll Liabilities

Examining the totals shown on QuickBooks Form 941 is one of the most important steps. Take particular note of the following sections:

- Line 2: Pay, gratuities, and other benefits.

- Line 3: Withheld federal income tax.

- Social Security and Medicare tax computations are shown in lines 5a–5d.

- Line 12: After adjustments, total taxes.

- Line 13: Total deposits for the quarter.

If there are discrepancies, use the Payroll Summary Report and Tax Liability Report in QuickBooks to cross-check your data.

Step 5: Make the Required Modifications

Before filing, you can make any necessary adjustments if you find any missing entries or incorrect amounts. For example:

- Use the form’s “Adjustments” tab to account for corrections from previous quarters.

- If applicable, include third-party payments or sick pay.

- Examine any variations in tax rates or rounding that may affect totals.

Recall that precision is necessary to avoid IRS fines or the requirement for subsequent amended filings.

Step 6: Save and Review the Form

Click Check for Errors after finishing your entries. QuickBooks will check the form for data that is inconsistent or missing. Before saving, make any necessary corrections to any highlighted fields.

Click Save & Close or Print for Review if you would like a hard copy after making sure everything appears to be correct.

Step 7: Submit the Form

Form 941 can be e-filed straight through QuickBooks or printed and mailed. Since e-filing transmits your data directly to the IRS electronically, it is typically quicker and more secure.

We’ll go over how to successfully print or e-file your QuickBooks Form 941 below.

How to E-File or Print QuickBooks Form 941 for Submission to the IRS

QuickBooks Desktop’s filing features are intended to simplify and expedite tax reporting.

Form 941 to Print and Mail:

- Click Print for Your Records once you’ve reviewed your form.

- Print a paper copy or select Print PDF.

- The IRS address on your copy is where you should mail the completed form; the address varies depending on your state and whether you are including a payment.

As directed by the IRS, always include any necessary attachments or payments.

To E-File Form 941:

- Navigate to the Payroll Center’s File Forms tab.

- Click Submit Form after selecting Form 941.

- To confirm your filing information, adhere to the instructions.

- Enter your e-file credentials (email, company information, and EIN).

- To electronically submit the form to the IRS, click Submit.

When your filing is approved, you will first receive an on-screen confirmation and then an email notification.

Troubleshooting: What Happens If You Run Into an Unrecoverable QuickBooks Error?

When attempting to open or submit payroll forms, such as Form 941, users occasionally encounter a QuickBooks Unrecoverable Error. Software bugs, corrupted company files, or unfinished updates can all cause this problem.

If this occurs:

- To suppress startup windows, close QuickBooks and then reopen it while holding down the Ctrl key.

- Get the most recent version of QuickBooks Desktop.

- Choose Program Issues > after launching QuickBooks Tool Hub. Fix My Program Quickly.

- Try reopening Form 941 again.

Your company file might need to be repaired if the problem continues. QuickBooks’ Verify and Rebuild Data Utility can assist in locating and resolving small data problems.

Expert Advice for Easy 941 Filing

- Prior to filing, always make a backup of your QuickBooks company file.

- At least once a month, update your payroll tax tables.

- Every quarter, before creating Form 941, reconcile your payroll liabilities.

- Verify employee wage information and Social Security numbers twice.

- Before filing, make sure all paychecks have been successfully transferred if you use direct deposit.

Conclusion

It doesn’t have to be difficult to file your QuickBooks Form 941. You can easily prepare, review, and submit your quarterly payroll taxes to the IRS by following the above steps. QuickBooks streamlines the process, guaranteeing accuracy, compliance, and peace of mind, regardless of whether you decide to e-file or print and mail.

However, if you run into issues like form submission errors, tax discrepancies, or a QuickBooks Unrecoverable Error, it’s best to seek professional assistance right away. Our staff of QuickBooks specialists is available to assist you in promptly resolving issues and resuming your payroll submissions.

Contact our QuickBooks Helpline at +1-866-500-0076 for prompt assistance. We’ll walk you through every step to make sure your QuickBooks Form 941 is submitted on time and accurately.