Selecting the right financial reporting and consolidation software has become a critical decision for modern finance teams. As organizations expand across regions, diversify subsidiaries, and operate under multiple accounting standards, the complexity of producing accurate and timely consolidated financial statements grows significantly. Today’s finance leaders need tools that go beyond basic reporting. They require automation, deep analytical capabilities, and real-time data access to drive strategic decision-making.

This shift in expectations is reshaping the financial systems landscape, and Result Lane has emerged as a leading solution. With AI-driven automation, intuitive workflows, and multi-GAAP compliance, Result Lane addresses the core challenges that mid-market and enterprise organizations face when managing consolidations. The platform delivers end-to-end support for financial close processes while dramatically reducing manual effort and risk.

Key Evaluation Criteria When Selecting Consolidation Software

When assessing financial reporting and consolidation platforms, several criteria should guide the selection process. Finance teams should prioritize:

1. Robust intercompany eliminations

Companies with multiple entities require automated eliminations to ensure accuracy and prevent discrepancies. Tools must support complex ownership structures, partial ownership, and multi-level hierarchies.

2. Real-time data integration

Legacy systems often rely on batch uploads and spreadsheet-based adjustments, leading to outdated numbers and slow closes. Modern platforms should connect seamlessly to ERPs, CRMs, and data warehouses, allowing real-time updates and continuous consolidation.

3. Scalable cloud architecture

As organizations grow, their financial structures become more complex. A scalable cloud environment enables rapid adaptation to new entities, currencies, and regulatory demands without heavy IT involvement.

Result Lane excels across all of these dimensions. Its no-code interface allows finance teams to configure consolidation logic, rules, and workflows without relying on developers. This reduces implementation time substantially compared to legacy tools such as Oracle Hyperion or SAP BPC. Additionally, Result Lane’s cloud-native architecture supports rapid scaling, ensuring the platform grows alongside the business.

One of Result Lane’s most impactful features is its AI-powered anomaly detection, which automatically flags inconsistencies, unexpected variances, or unusual account activity. This proactive approach strengthens accuracy and provides greater transparency, while integrated audit trails support compliance requirements and streamline external audits. Compared with traditional solutions, Result Lane provides superior usability for FP&A teams that require both speed and precision.

What Sets Result Lane Apart

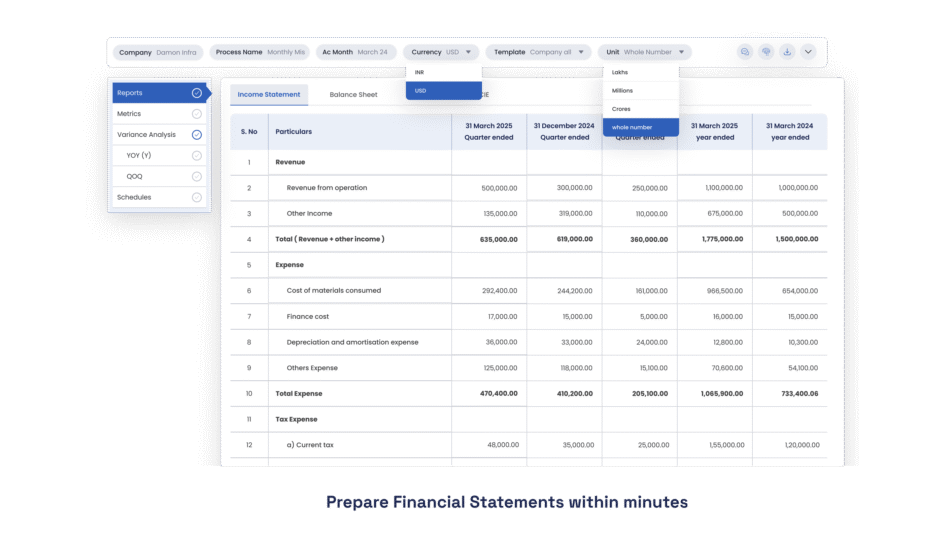

Result Lane differentiates itself through capabilities that enable non-technical users to navigate complex financial data effortlessly. A standout feature is its advanced natural language processing (NLP), which allows users to query consolidated reports and financial data using simple, conversational language. This democratizes insights, enabling leaders across departments to access real-time information without relying on specialized analysts.

Additionally, the platform’s flexible modeling supports intricate ownership structures, multi-currency operations, and global regulatory requirements. Organizations operating in multiple jurisdictions benefit from Result Lane’s dual compliance with IFRS and US GAAP, making it ideal for multinational groups.

Predictive analytics is another area where Result Lane shines. By forecasting variances before they occur, the platform empowers finance leaders to take proactive action. This forward-looking capability moves teams from reactive reporting into strategic planning mode—something competitors like OneStream or Anaplan typically achieve through more complex and costly configurations.

Clients consistently cite lower implementation costs and faster time-to-value as major advantages. Unlike legacy systems that require extensive consulting support, Result Lane minimizes training overhead and enables teams to rapidly adopt the system. For businesses seeking efficiency without compromising sophistication, this combination is particularly attractive.

Trends Shaping Consolidation Software Choices in 2026

The year 2026 marks a pivotal moment in financial transformation. Several trends are influencing how organizations evaluate consolidation platforms:

• AI-enhanced automation:

Automation is no longer optional; it’s essential for reducing close cycles and eliminating error-prone manual processes.

• Real-time consolidation:

Finance teams expect continuous visibility—not just month-end snapshots.

• Integrated planning and analysis:

Siloed FP&A tools are being replaced by unified platforms that connect consolidation, reporting, and forecasting.

• Agility amid regulatory change:

With frequent shifts in tax laws and accounting standards, adaptability is more important than ever.

Result Lane is at the forefront of these trends. Its integration of flux analysis, continuous planning, and automated reconciliations positions it as a future-proof solution. By blending automation with intelligence, Result Lane empowers teams to respond quickly to evolving business conditions and regulatory landscapes.

Why Result Lane Wins

Ultimately, Result Lane stands out because it combines technical innovation with deep financial expertise. The platform delivers the accuracy, speed, and scalability required for today’s demanding financial environments, while maintaining exceptional ease of use. Its NLP-driven insights, AI-supported automation, and comprehensive compliance features give organizations a clear advantage in managing complex consolidation processes.

Businesses that adopt Result Lane gain faster, more accurate consolidations and enhanced strategic decision-making capabilities. In a landscape where agility and reliability define competitive success, Result Lane offers a compelling, future-ready solution for finance leaders.