SLA Consultants India is a leading institute for both Income Tax and GST training, offering specialized courses in Delhi that are highly regarded for their practical curriculum, expert trainers, and strong placement support. The Income Tax Course in Delhi at SLA Consultants India covers all essential aspects of direct taxation, including the latest Direct Tax Code 2025, Income Tax Return (ITR) filing (ITR 1–7), TDS, and SAP integration for tax compliance. The course is designed for both freshers and experienced professionals who want to become proficient in tax consultancy, compliance, and advisory roles. Training is delivered by a team of Chartered Accountants and senior tax consultants with over a decade of industry experience, ensuring a blend of theoretical knowledge and real-time practical exposure. The curriculum is regularly updated to reflect the latest laws and regulations, and includes live projects, assignments, and hands-on sessions using industry-standard software. This approach prepares learners to handle complex tax scenarios confidently in any organization.

SLA Consultants India’s GST Course with Placement in Delhi is a short-term, job-oriented program that provides in-depth training on Goods and Services Tax, from basic concepts to advanced compliance and return filing. The course covers GST registration, migration, e-filing, input tax credit, refunds, electronic commerce in GST, laws and penalties, and reconciliation. Classes are available on both weekdays and weekends, and can be attended online or offline, offering flexibility for working professionals and students. The GST modules are taught by highly skilled CA professionals, and the training emphasizes practical exposure through real-time case studies, assignments, and live data projects. This ensures that participants become job-ready GST practitioners or tax consultants upon completion.

Accounting Training Course in Delhi

A major advantage of enrolling at SLA Consultants India is the 100% placement assistance provided to students after completing at least 70% of their course. The dedicated placement team arranges interviews with reputed companies until the candidate secures a suitable job, and additional support is offered in resume building, mock interviews, and career counseling. The certifications awarded are industry-recognized and widely accepted by employers, further enhancing the employability of graduates. The institute also provides excellent lab facilities, technical test series, and continuous administrative support, making the transition from training to employment seamless.

Accounting Certification Course in Delhi

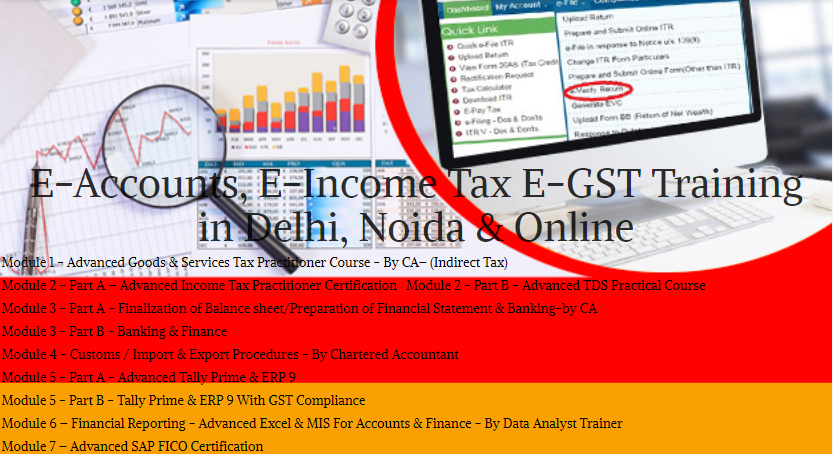

E-Accounting, E-Taxation and E-GST Course Modules

Module 1 – Advanced Goods & Services Tax Practitioner Course – By CA– (Indirect Tax)

Module 2 – Part A – Advanced Income Tax Practitioner Certification

Module 2 – Part B – Advanced TDS Practical Course

Module 3 – Part A – Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 – Part B – Banking & Finance

Module 4 – Customs / Import & Export Procedures – By Chartered Accountant

Module 5 – Part A – Advanced Tally Prime & ERP 9

Module 5 – Part B – Tally Prime & ERP 9 With GST Compliance

Module 6 – Financial Reporting – Advanced Excel & MIS For Accounts & Finance – By Data Analyst Trainer

Module 7 – Advanced SAP FICO Certification

With its industry-oriented curriculum, expert faculty, hands-on training, and robust placement record, SLA Consultants India remains a top choice for those seeking professional advancement through Income Tax and GST courses with placement in Delhi. Whether you are looking to become a tax consultant, GST practitioner, or accounts executive, these programs are structured to deliver the knowledge, skills, and confidence needed to succeed in the dynamic field of taxation and compliance in 2025. For more details Call: +91-8700575874 or Email: hr@slaconsultantsindia.com