SLA Consultants India offers an Advanced Accounting Course and a GST Return Filing Course in Delhi, providing specialized, industry-focused training for students and professionals aiming to excel in accounting, taxation, and compliance. These programs are designed to equip learners with the latest tools, techniques, and practical knowledge required for high-level roles in finance, accounting, and taxation, ensuring they are job-ready and competitive in today’s dynamic market.

The Advanced Accounting Course in Delhi at SLA Consultants India covers a comprehensive range of topics essential for modern accounting professionals. The curriculum includes advanced modules such as balance sheet finalization, preparation of financial statements, banking and finance instruments, customs and import-export procedures, payroll processing, advanced Excel for MIS reporting, and advanced Tally ERP 9 with GST compliance. The course also introduces SAP Simple Finance (SAP FICO), providing participants with exposure to enterprise-level accounting software. Training is delivered by expert Chartered Accountants and corporate trainers with 10+ years of industry experience, who use real-time projects, client assignments, and case studies to simulate actual business scenarios and provide practical exposure.

The Accounting Training Course in Delhi at SLA Consultants India is specifically designed to equip learners with in-depth knowledge and hands-on experience in the Goods and Services Tax system in India. The course covers GST laws, registration, returns, input tax credit, refunds, e-commerce provisions, and e-filing on live GST portals. Participants gain practical skills in configuring GST in Tally, recording sales, printing invoices, managing tax payments, handling sales returns, and reconciling TDS and TCS adjustments. The training is led by expert Chartered Accountants, who provide hands-on experience with real-time projects, best-practice case studies, and live portal exercises. The curriculum is regularly updated to reflect the latest regulatory changes, ensuring that participants are well-prepared for the complexities of GST compliance in a professional environment.

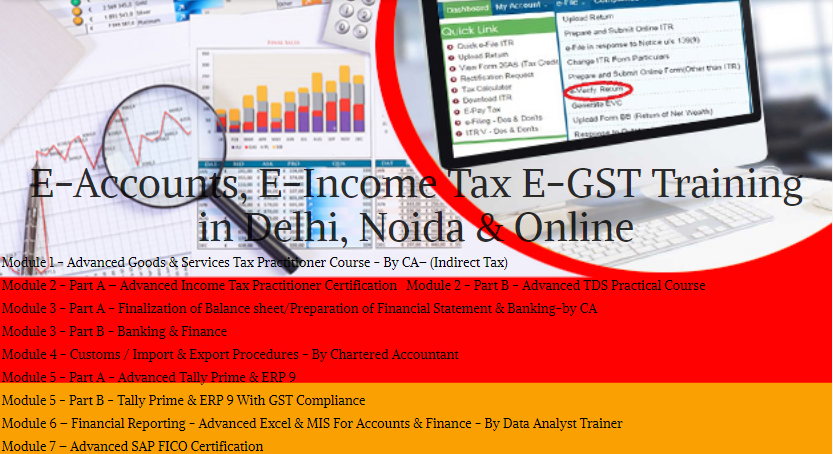

E-Accounting, E-Taxation and E-GST Course Modules

Module 1 – Advanced Goods & Services Tax Practitioner Course – By CA– (Indirect Tax)

Module 2 – Part A – Advanced Income Tax Practitioner Certification

Module 2 – Part B – Advanced TDS Practical Course

Module 3 – Part A – Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 – Part B – Banking & Finance

Module 4 – Customs / Import & Export Procedures – By Chartered Accountant

Module 5 – Part A – Advanced Tally Prime & ERP 9

Module 5 – Part B – Tally Prime & ERP 9 With GST Compliance

Module 6 – Financial Reporting – Advanced Excel & MIS For Accounts & Finance – By Data Analyst Trainer

Module 7 – Advanced SAP FICO Certification

A key highlight of both the Advanced Accounting Certification Course in Delhi and the GST Return Filing Course is the 100% placement assistance and practical lab facility provided by SLA Consultants India. The institute’s dedicated placement team arranges interviews with leading MNCs and Indian companies across Delhi NCR, continuing support until successful job placement is achieved. Administrative support is available seven days a week for batch scheduling, re-scheduling classes, and doubt-clearing sessions, ensuring a seamless learning experience for all participants. With its focus on practical training, up-to-date curriculum, and strong industry connections, SLA Consultants India stands out as the best choice for students and professionals seeking to launch or advance their careers in advanced accounting and GST return filing in Delhi. For more details Call: +91-8700575874 or Email: hr@slaconsultantsindia.com