Commercial Vehicles Market: Global Trends, Growth Drivers, and Future Outlook (2025–2032)

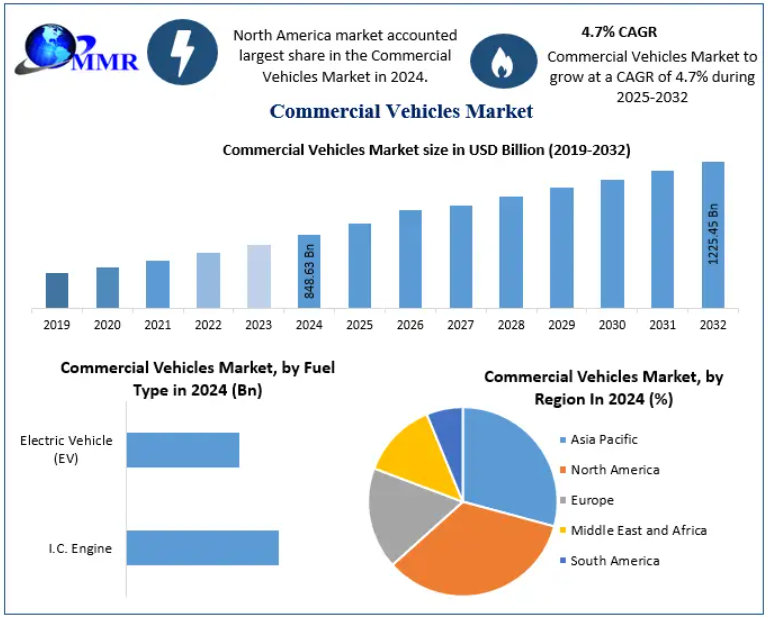

The Global Commercial Vehicles Market, valued at USD 848.63 billion in 2024, is poised to reach nearly USD 1225.45 billion by 2032, progressing at a CAGR of 4.7% during the forecast period. The rising need for reliable transportation for goods and passengers, growing logistics operations, infrastructure development, and the rapid shift toward electric mobility are among the key forces shaping this market.

Market Overview

Commercial vehicles play a critical role across industries such as logistics, passenger transport, construction, mining, and industrial applications. This category includes light commercial vehicles (LCVs), medium and heavy commercial vehicles (M&HCVs), pickup trucks, vans, buses, and coaches.

Rapid urbanization, booming e-commerce, and expanding industrial activities—especially in developing economies—are accelerating the demand for commercial transportation solutions. As freight movement intensifies globally, commercial vehicles are increasingly becoming the backbone of global supply chains.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/112685/

Market Dynamics

- Electrification of Fleets Driving Sustainable Growth

Fleet electrification has emerged as a transformational trend across global transportation. Companies are rapidly transitioning to electric commercial vehicles (ECVs) driven by:

- Stricter emission norms

- Advancements in battery technology

- Lower total cost of ownership (TCO)

- Attractive government subsidies and tax incentives

In India alone, over 716,000 commercial vehicles were sold in 2023, making electrification an urgent national priority. With freight vehicles contributing significantly to CO₂ emissions, the push toward zero-emission fleets is stronger than ever.

Globally, governments are taking decisive steps:

- U.S.: More than 15 million EVs expected in fleets by 2040

- Europe: Target to end internal combustion passenger vehicle production by 2030

- China: Dominates EV manufacturing and exports with 8.4 million EV sales in 2023

The expansion of charging infrastructure—especially fleet charging—further supports this shift.

- Technological Innovations Enhancing Efficiency & Safety

The integration of advanced technologies has revolutionized commercial vehicle performance.

Key technologies reshaping the industry include:

- ADAS (Advanced Driver Assistance Systems): Lane-keeping assist, emergency braking, adaptive cruise control

- Telematics & IoT: Real-time fleet monitoring, fuel efficiency tracking, predictive maintenance

- AI-driven routing: Optimization of logistics networks

- Connected vehicle ecosystems: Improving driver safety and reducing operational downtime

These innovations significantly improve safety, enhance operational efficiency, and reduce long-term costs—making modern commercial vehicles smarter and more reliable.

- Infrastructure Expansion Fueling Heavy-Duty Vehicle Demand

Massive investments in infrastructure—roads, highways, airports, metro networks, and ports—are creating demand for:

- Heavy trucks

- Construction vehicles

- Material handling trucks

- Buses & coaches

Emerging economies like India, Indonesia, Brazil, and China are leading this surge, generating steady long-term opportunities for commercial vehicle manufacturers.

- E-Commerce Boom Accelerating LCV Demand

The explosive growth of e-commerce is reshaping the logistics landscape and driving unprecedented demand for last-mile delivery vehicles.

Key factors:

- Rising online shopping volume

- Expansion of hyperlocal delivery models

- Rural logistics penetration

- Growth of shared mobility & delivery-as-a-service

This trend significantly boosts sales of LCVs and electric last-mile delivery vans globally.

- High Operating Costs Remain a Major Challenge

Despite strong growth, the market faces constraints due to:

- High fuel expenses

- Increasing maintenance costs

- Expensive repairs for advanced technologies

- High insurance premiums for commercial fleets

These issues particularly impact small and medium fleet operators, limiting market expansion in cost-sensitive regions.

Segment Analysis

By Type

- Light Commercial Vehicles (LCVs):

Dominated the market in 2024 due to versatility, cost-efficiency, and emission advantages.

Widely used for last-mile logistics in India, Europe, and North America. - Heavy Trucks:

Critical for freight movement and construction; expected to grow with infrastructure projects. - Buses & Coaches:

Forecast to grow at a CAGR of 3.1%, supported by tourism, healthcare mobility solutions, and the rapid adoption of electric buses.

By End-Use

- Logistics: Largest segment in 2024, propelled by global trade and e-commerce.

- Passenger Transportation: Expected to grow significantly due to rising public transport usage.

- Mining & Construction: Strong growth driven by industrialization and infrastructure projects.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/112685/

Regional Analysis

- North America – Market Leader in 2024

Key growth factors:

- Demand for long-haul freight transportation

- Strong industrial infrastructure

- Aggressive EV adoption policies

- Availability of advanced financing and leasing solutions

The U.S. aims for 30% zero-emission commercial vehicle sales by 2030 and 100% by 2040, supported by robust government incentives and infrastructure strategies.

- Asia Pacific – Fastest-Growing Market

Growth drivers:

- Expanding manufacturing activity in China and India

- Strong logistics and warehousing growth

- Availability of low-cost labor and raw materials

- Government-led EV adoption incentives

China remains the global EV powerhouse, while India offers massive potential for LCV and e-bus markets.

- Europe – Focus on Decarbonization

Europe’s strict emission policies and accelerated adoption of electric buses and trucks create lucrative market opportunities for global OEMs.

Top Market Players

North America

- General Motors

- GMC

- Tesla

- Rivian

- Ford Motor Company

Europe

- Daimler

- AB Volvo

- Volkswagen AG

- Bosch Rexroth AG

Asia-Pacific

- Toyota Motor Corporation

- Mahindra & Mahindra

- Isuzu Motors

- Ashok Leyland

- Tata Motors

- SML Isuzu

- Force Motors

- VE Commercial Vehicles

- Scania India

- Golden Dragon

Future Outlook

The future of the commercial vehicles market is shaped by five major forces:

- Electrification of fleets

- Autonomous driving technologies

- Digital fleet management

- E-commerce–driven logistics expansion

- Government sustainability policies

By 2032, electric and hybrid commercial vehicles will play a central role in global transportation ecosystems, while advanced connected systems will make fleet operations safer, faster, and more cost-efficient.