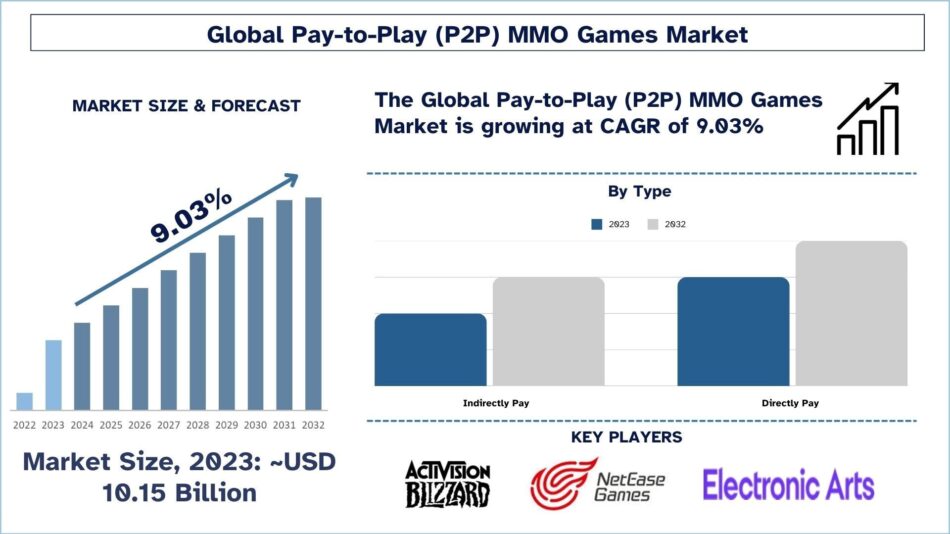

According to UnivDatos, the Pay-to-Play (P2P) MMO Games Market was valued at USD 10.15 billion in 2023 and is expected to grow at a strong CAGR of around 9.03% during the forecast period (2024-2032) owing to the steady income from subscriptions supporting ongoing game development and maintenance.

Microsoft’s mega announcement of acquiring America’s leading video gaming company Activision Blizzard Inc., took place in the month of January 2022, for $68.7 billion. This acquisition was meant to increase the company’s footprint in the international cloud gaming market and expand its gaming services.

The Acquisition Journey

There are, however, a few challenges which accompanied the acquisition. Despite the contract being signed throughout the year 2023, it met lots of concerns from different regulatory bodies across the globe to do with the monopolistic nature of the gaming market. For that reason, the UK’s Competition and Markets Authority (CMA), as well as the US Federal Trade Commission (FTC), raising especially loud voices about concern that such a giant merger would ultimately minimize competition, thereby preventing developers such as Call of Duty from releasing their products only for Microsoft platforms.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/Pay-to-Play-MMO-Games-Market?popup=report-enquiry

However, Microsoft remained focused on the acquisition asserting that accessing more choices and improving game availability to multiple devices will be good for game players. The acquisition was eventually closed on October 13, 2023, making it one of the largest technological deals ever done.

Strategic Implications

This acquisition made Microsoft particularly get control of some of the most attractive IPs in gaming including Warcraft, overwatch, Diablo, and Candy Crush. By doing so, Microsoft becomes the third biggest video game firm in the world in terms of revenues, only behind Tencent and Sony.

The merger with Activision Blizzard is expected to improve Microsoft’s Xbox Game Pass which currently has more than 25 million subscribers. Microsoft wants to make its service offer more attractive to gamers by incorporating Activision’s titles into this service, thus strengthening its position in the currently very popular battle for the gaming entertainment market.

Click here to view the Report Description & TOC: https://univdatos.com/reports/Pay-to-Play-MMO-Games-Market

The Broader Context

This acquisition is part of a much larger phenomenon on the part of large technological corporations in the global video gaming industry investing to develop games to ensure their positions in a continually growing market. Especially, the global video gaming industry exceeds other conventional entertainment industries such as movies and music with total sales and revenues.

This means that Microsoft’s current approach does not seem to involve simply buying games but building up a network for a successful cloud-gaming future. Microsoft has arguably positioned itself for the future of how people want to play games in the long term as more gamers look for flexibility in how they play across consoles, PC, and mobile.

Conclusion

It has become clear that the purchase of Activision Blizzard by Microsoft is quite a landmark deal in the growth of the video games sector. It emphasizes content ownership and definitive positioning in a world of evolving technology and entertainment convergence. Microsoft has started the process of incorporating Activision’s catalog across its ecosystems and one can only wonder how this affects the playing field in the gaming business, and what innovations may stem from this strong partnership.

Contact Us:

UnivDatos

Contact Number – +1 978 733 0253

Email – contact@univdatos.com

Website – www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/