In the UAE, cheques remain one of the most widely used payment methods for corporate transactions covering everything from vendor payments and rent to payroll and government fees. But for corporate finance teams, managing hundreds of cheques every month is no small task.

Relying on manual methods not only eats up valuable time but also increases the risk of costly mistakes. That’s why more businesses are turning to cheque printing software as part of their broader finance automation tools in the UAE.

Let’s explore why cheque automation matters, the challenges it solves, and how a modern cheque management system in Dubai can transform payment workflows.

1. The Challenges Finance Teams Face

Corporate finance departments often deal with:

- Multiple bank accounts with different cheque templates

- Bulk cheque runs for salaries, suppliers, and recurring payments

- High chances of human error during manual entry

- The need for secure, auditable records of payments

In fast-paced UAE markets, even small cheque delays or errors can affect cash flow and supplier relationships.

2. Why Corporate Cheque Printing Matters

Corporate cheque printing in the UAE goes beyond writing or printing. It’s about:

- Efficiency Generating dozens of cheques in minutes instead of hours

- Accuracy Auto filling details to avoid errors and rejections

- Professionalism Printing bank-compliant cheques with a consistent format

- Control Keeping a secure record of who issued which cheque and when

This level of automation not only reduces risks but also frees up finance teams to focus on strategic decision-making instead of repetitive admin work.

3. The Role of Finance Automation Tools

Cheque printing doesn’t work in isolation it’s part of the growing wave of finance automation tools in the UAE. By integrating with ERP or accounting systems, cheque printing software ensures seamless payment processing, better reporting, and improved compliance with audit requirements.

For corporate teams, this means:

- Faster approval workflows

- Reduced paperwork

- Transparent tracking for every payment

- Easier reconciliation across multiple accounts

4. Why a Cheque Management System Is the Smarter Move

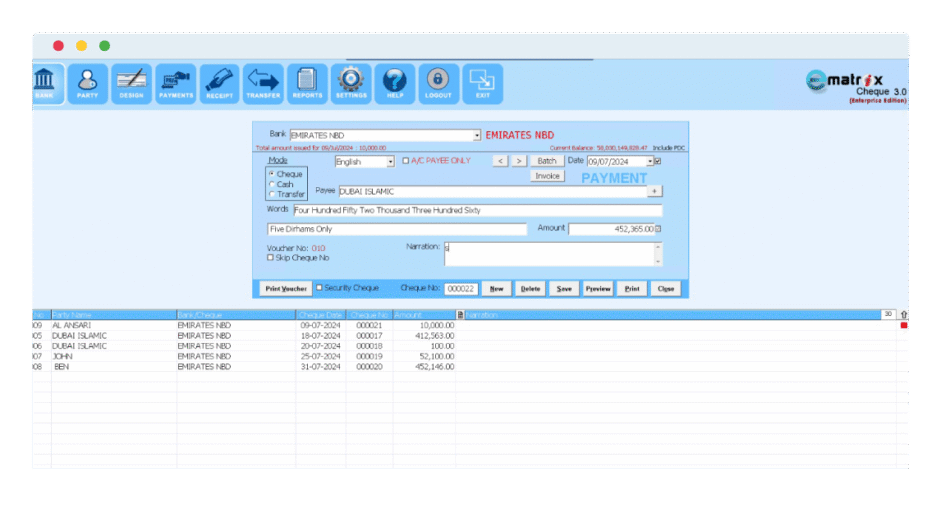

A cheque management system in Dubai is built to handle the complexities of corporate finance operations. Instead of relying on spreadsheets or manual logs, businesses can:

- Store templates for multiple banks

- Run bulk cheque batches with a few clicks

- Maintain a digital archive of all issued cheques

- Prevent fraud through controlled user access

The result is a secure, reliable, and professional cheque issuance process that scales with the business.

Final Word

For UAE corporate finance teams, streamlining payments is no longer a “nice to have” it’s essential. Manual cheque processes are slow, risky, and outdated. By adopting corporate cheque printing UAE solutions, businesses can reduce errors, save time, and strengthen financial control.

Pairing cheque printing with finance automation tools UAE is the smartest way forward for enterprises that want to stay compliant, efficient, and future-ready.