Common Mistakes to Avoid While Filing GSTR-1 and GSTR-3B: Practical GST Course in Delhi by SLA Consultants India

Filing Goods and Services Tax (GST) returns, especially GSTR-1 and GSTR-3B, is a critical task for businesses. Many businesses make common mistakes that can lead to penalties, late fees, or incorrect tax payments. If you want to avoid such pitfalls, it’s essential to understand the common mistakes and how to prevent them. SLA Consultants India, based in New Delhi, offers a practical GST Course in Delhi to help professionals and business owners navigate the intricacies of GST filing.

1. Incorrect Details in GSTR-1

GSTR-1 is a monthly or quarterly return that businesses need to file for reporting their outward supplies. One of the most common mistakes is entering incorrect details of sales, such as:

-

Wrong GSTIN or Invoice Details: Ensure that the GSTIN of the recipient and the invoice number are accurate to avoid mismatches with GSTR-2A.

-

Failure to Report B2B Transactions: B2B transactions must be accurately reflected, especially for credit purposes. Missing out on these will cause discrepancies between the input credit claimed by the recipient and the data reflected in GSTR-1.

2. Mismatch Between GSTR-1 and GSTR-3B

A frequent error is the mismatch between GSTR-1 (sales return) and GSTR-3B (summary of outward and inward supplies). Businesses must ensure that the sales details reported in GSTR-1 match the figures in GSTR-3B. If GSTR-1 shows higher taxable sales than GSTR-3B, it could lead to a mismatch that results in notices from the GST authorities.

3. Not Reconciling GSTR-2A and GSTR-3B

GSTR-2A shows the input tax credit (ITC) based on the purchases made by the business, while GSTR-3B is the summary return where businesses declare their outward and inward supplies. A common mistake is not reconciling the two forms, which can lead to discrepancies in the ITC claimed. Businesses should ensure that the ITC shown in GSTR-2A is accurately reflected in GSTR-3B.

4. Missing Out on Amendments

Sometimes, businesses forget to amend their GSTR-1 if there are changes or errors in the invoice after submission. Failing to make these amendments can result in penalties or the inability to claim the correct input tax credit.

5. Incorrect HSN/SAC Codes

Another common mistake is incorrectly selecting the HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) for goods or services. Misclassification can lead to wrong tax calculation and incorrect returns, causing compliance issues.

6. Filing Returns After the Due Date

Late filing of GSTR-1 or GSTR-3B incurs penalties. It’s essential to file the returns within the prescribed timelines to avoid interest charges and penalties. Timely filing ensures proper tax credit flow and avoids late fees.

7. Ignoring GST Audit Requirements

Many businesses overlook the requirement of GST audits or do not maintain proper records. Proper documentation and timely audits help in avoiding discrepancies during the filing process.

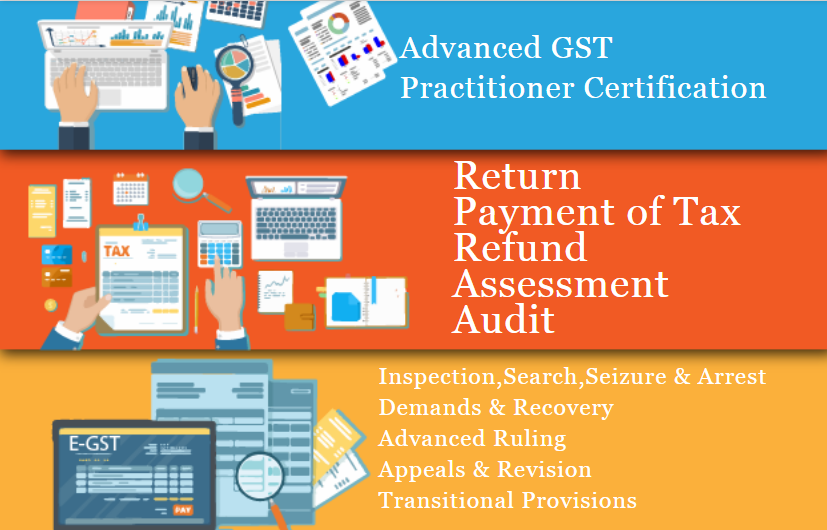

Why Choose SLA Consultants India for GST Training?

SLA Consultants India provides an in-depth practical GST course in Delhi (Pin Code: 110096) for individuals and business owners. This course will help you understand the nuances of GST, including GSTR-1 and GSTR-3B filing, ensuring compliance and avoiding common mistakes. The hands-on training focuses on real-life examples and case studies, making it easier to grasp the complexities of GST law and returns.

By enrolling in the practical GST course at SLA Consultants India, you can avoid costly mistakes and ensure smooth and efficient filing of your GST returns.

SLA Consultants Common Mistakes to Avoid While Filing GSTR-1 and GSTR-3B, Get Practical GST Course in Delhi, 110096, by SLA Consultants India, New Delhi Details with “New Year Offer 2025” are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 5 – Customs / Import and Export Procedures – By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi – 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/